44 are treasury bills zero coupon bonds

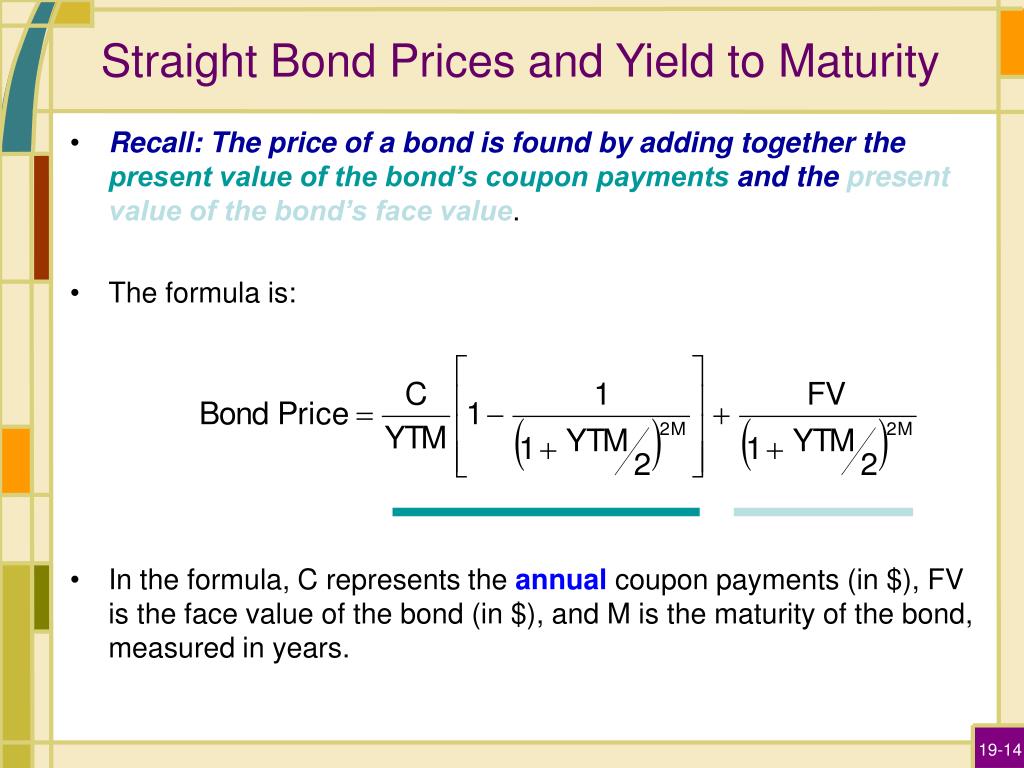

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves combined. Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Are treasury bills zero coupon bonds

B treasury bills are zero coupon bonds c zero coupon - Course Hero B) Treasury bills are zero-coupon bonds. C) Zero-coupon bonds always trade at a discount. D) The yield to maturity is typically stated as an annual rate by multiplying the calculated YTM by the number of coupon payment per year, thereby converting it to an APR. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Investing in Treasury Bills: The Safest Investment in 2022? Treasury bills are considered the safest bonds in the world because the U.S. government backs them. And because of their short maturity, T-bills are seen as the safest of the safe. This is important as it is a significant reason why there is a demand for investing in Treasury bills. Because T-bills have such short maturities, their interest isn ...

Are treasury bills zero coupon bonds. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Most bonds make regular interest or "coupon" payments—but not zero-coupon bonds. Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Can you lose money on Treasury notes? | Note Brokering Treasury bills are not like coupon bonds that pay interest in accruals. What are Treasury bills example? Treasury bills are zero-coupon securities and do not pay interest. They are issued at a discount and are redeemed at face value at maturity. For example, a 91-day treasury bill of Rs. 100 / - (nominal value) can be issued for example Rs. ... Treasury Bills - Guide to Understanding How T-Bills Work Treasury Bills (or T-Bills for short) are a short-term financial instrument that is issued by the US Treasury with maturity periods ranging from a few days up to 52 weeks (one year). They are considered among the safest investments since they are backed by the full faith and credit of the United States Government. Zero-Coupon Bond - Definition, How It Works, Formula It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds.

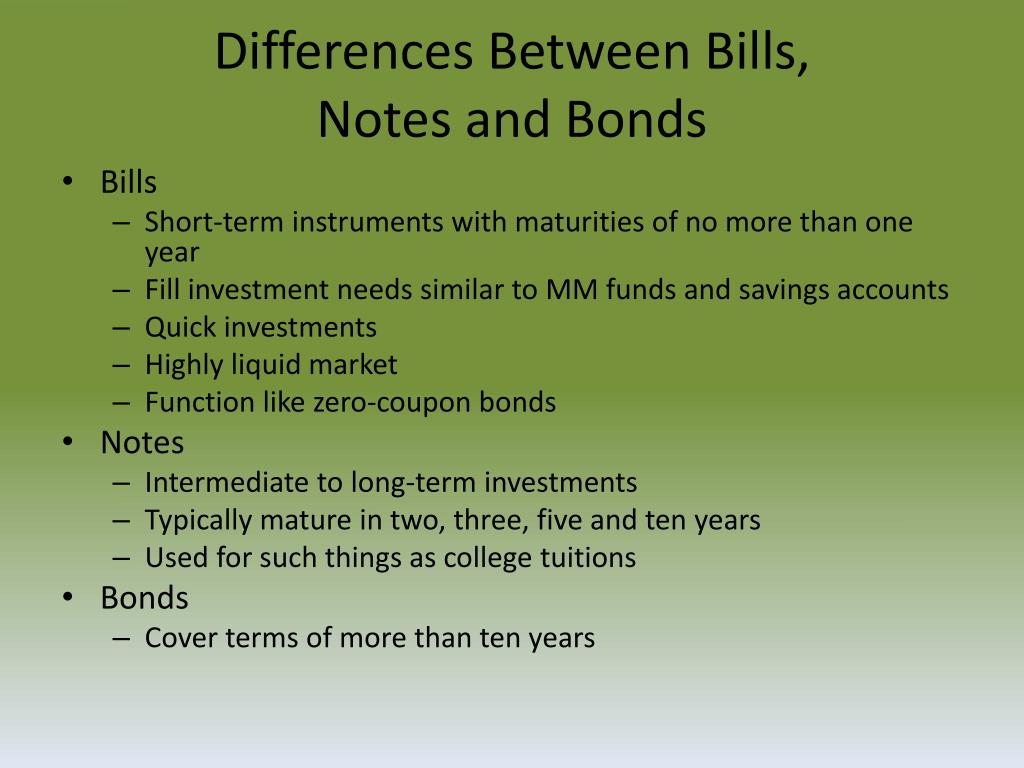

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo Treasury bills are a type of zero-coupon security where the central government borrows funds from the individual for a period of 364 days or less. In return, the investors receive interest. These money market instruments provide a return on investment at once, and there is no provision for periodic returns. Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Treasury bonds are long terms bonds issued by the government with a maturity of more than 10 years. A treasury bond is called T-Bonds. A bond pays a specific rate of interest on the principal amount to the holders. Treasury Bills Treasury bills categories into 3 bills as per maturity namely, a) 91 Day b) 182 Day c) 364 Day. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068. Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Treasury bills are debt papers issued by the government or corporations in order to raise money and have a tenure of less than one year and are generally issued for tenures of 91 days, 182 days, and 364 years. Whereas Bonds are also a debt instrumen t issued by the government and corporations in order to raise debt.

What's the difference between a zero-coupon bond and a Treasury bill ... T-bills are also called as zero coupon bond, which is issued at discount. T bills are short term instruments issued within one year. 91 days, 182 days, 364 days are the examples of maturity period. T-bills are issued by goverment of any country. One point to remember Investing in Treasury Bills: The Safest Investment in 2022? Treasury bills are considered the safest bonds in the world because the U.S. government backs them. And because of their short maturity, T-bills are seen as the safest of the safe. This is important as it is a significant reason why there is a demand for investing in Treasury bills. Because T-bills have such short maturities, their interest isn ... US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. B treasury bills are zero coupon bonds c zero coupon - Course Hero B) Treasury bills are zero-coupon bonds. C) Zero-coupon bonds always trade at a discount. D) The yield to maturity is typically stated as an annual rate by multiplying the calculated YTM by the number of coupon payment per year, thereby converting it to an APR.

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

Post a Comment for "44 are treasury bills zero coupon bonds"