38 zero coupon bonds duration

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. Therefore, in case of longer time duration (a higher 'N'), it might prove to be profitable for the bond holder. Disadvantages of Zero-Coupon Bonds. However, there are also certain drawbacks of zero-coupon bonds that need to be included in the ... duration of zero coupon bonds | Forum | Bionic Turtle The Macaulay duration of a zero-coupon bond equals its maturity, such that the Mac duration of a zero-coupon bond must be monotonically increasing, and. DV01 = Price * Mod duration /10000, where in the case of a zero coupon bond: Price is a decreasing function of maturity (i.e., a zero is acutely "pulled to par"), but Mod duration is an ...

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Zero coupon bonds duration

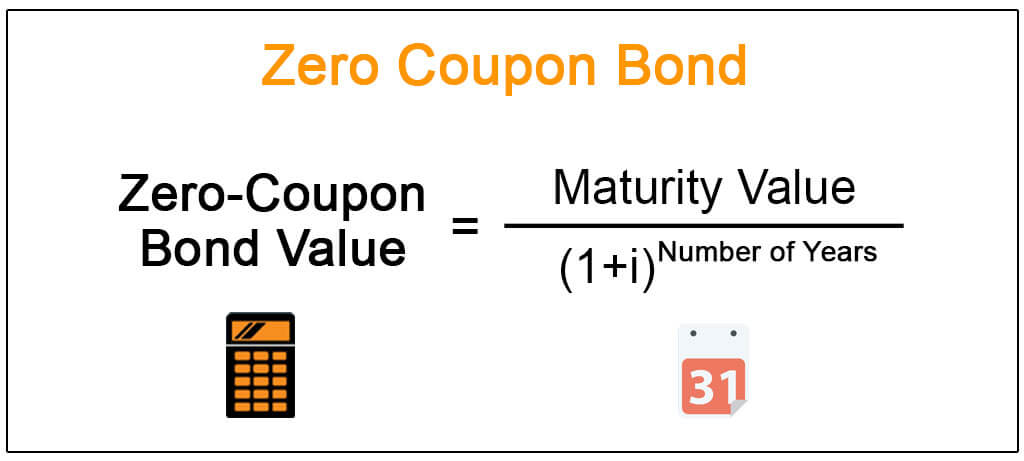

What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Dollar Duration - Overview, Bond Risks, and Formulas Formulas. Dollar duration is represented by calculating the dollar value of one basis point, which is the change in the price of a bond for a unit change in the interest rate (measured in basis points). The dollar value per 100 basis point can be symbolized as DV01 or Dollar Value Per 01. A 1% unit change in the interest rate is 100 basis points. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

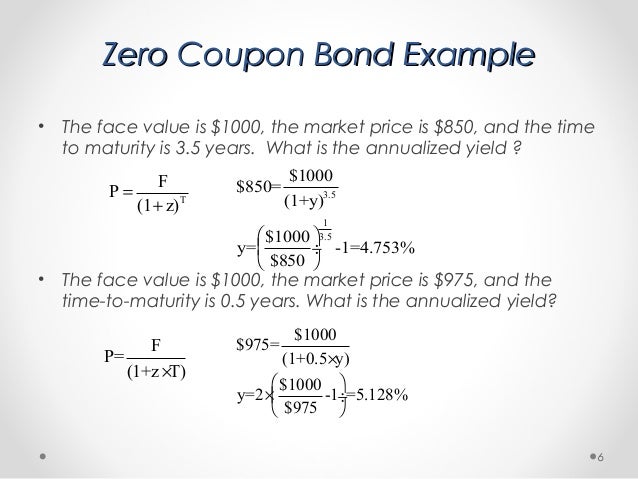

Zero coupon bonds duration. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond Modified Duration Formula - Bionic Turtle Zero-coupon bonds are popular (in exams) due to their computational convenience. We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Dollar Duration - Overview, Bond Risks, and Formulas Formulas. Dollar duration is represented by calculating the dollar value of one basis point, which is the change in the price of a bond for a unit change in the interest rate (measured in basis points). The dollar value per 100 basis point can be symbolized as DV01 or Dollar Value Per 01. A 1% unit change in the interest rate is 100 basis points. What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "38 zero coupon bonds duration"