44 find the face value of the zero coupon bond

How to Calculate the Price of a Zero Coupon Bond Divide the face value of the bond to calculate the price to pay for the zero-coupon bond to achieve your desired rate of return. Zero-Coupon Bond Price Example For example, say you want to earn a 6 percent rate of return per year on a bond with a face value of $2,000 that will mature in two years. First, divide 6 percent by 100 to get 0.06. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Solved Find the face value of the zero-coupon bond. | Chegg.com Find the face value of the zero-coupon bond. 20-year bond at 5.95 %; price $9050 The face value of the zero-coupon bond will be $ ____. (Round to the nearest dollar as needed.)

Find the face value of the zero coupon bond

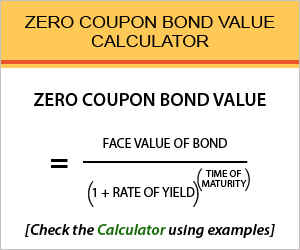

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Find the face value of the zero coupon bond. Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ... Zero Coupon Bond - GitBook A zero coupon bond generates gains from the difference between the purchase price and the face value while a coupon bond produces gains from the regular distribution of coupon/interest. Zero coupon bonds are issued at a deep discount and repaid the face value at maturity. The greater the length of the maturity is the cheaper price a bond has. Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond: Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2.

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. How Do Zero Coupon Bonds Work? - SmartAsset When the bond reaches maturity, you'll get the par value (or face value) of the bond. The difference between the purchase price and the par value goes to you as profit. That amassed profit gives the zero coupon bond its other name: accrual bond. Zero coupon bonds can be issued by f inancial institutions, c orporations, and f ederal agencies or municipalities. Some of those bonds are initially issued as zero coupon bonds. How to Calculate Face Value of a Bond in Excel (3 Easy Ways) For the last method, we will find the face value for a Zero Coupon Bond in Excel. We will use the following formula. Remember, the Annual Coupon Rate is 0% for a Zero Coupon Bond. Steps: Firstly, type this formula in cell C10. =C5* (1+C8/C7)^ (C7*C6) Then, press ENTER.

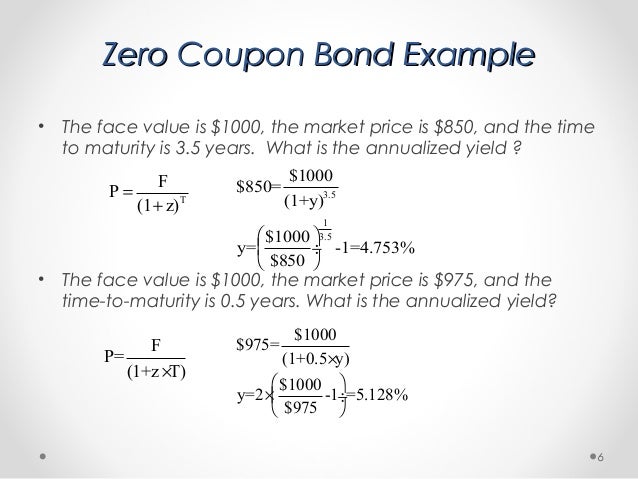

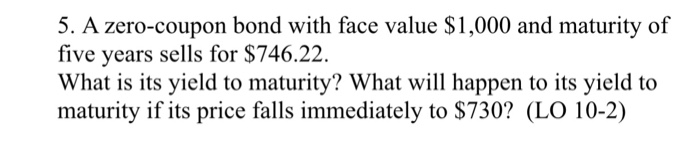

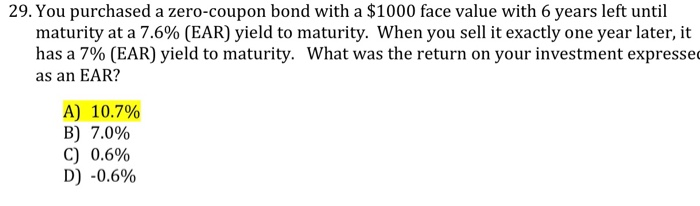

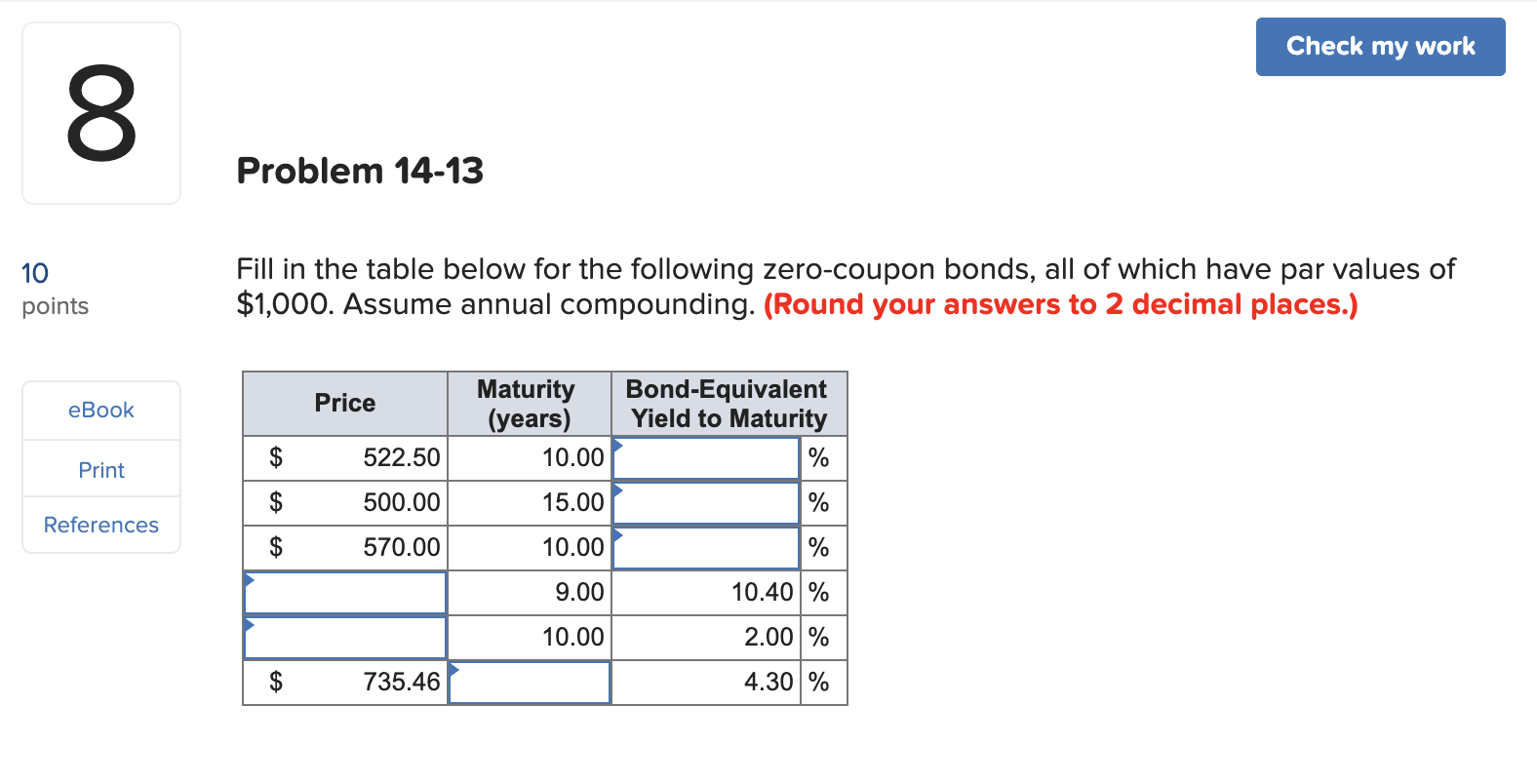

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Value and Yield of a Zero-Coupon Bond | Formula & Example Given the current price (or issue price) of a zero-coupon bond (denoted as P ), its face value (also called maturity value) of FV and total number of n coupon payments, we can find out its yield to maturity using the following equation: Zero-Coupon Bond Yield =. Face Value. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt. That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds.

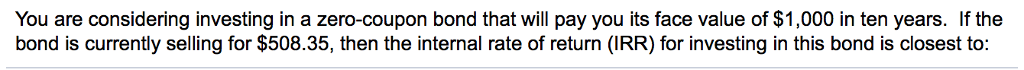

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. $1,000,000 / (1+0.03)20 = $553,675.75 Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions:

Solved Find the face value of the zero-coupon bond. 12-year | Chegg.com Find the face value of the zero-coupon bond. 12-year bond at 3.9% (compounded semiannually); price $14,000 The face value will be $ (Round to the nearest dollar as needed.)

Zero Coupon Bond Calculator - MiniWebtool Formula. The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Bond Yield Calculator.

What is a Zero Coupon Bond? - ICICIdirect The formula used to calculate the price of zero-coupon bonds is: Price = Face Value/ (1+r)^n . Where r is the annual return, and n is the number of years until maturity. Why invest in a Zero Coupon Bond 1. Returns are predictable . The most significant advantage of a zero-coupon bond is that the returns that you receive on them are known in ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero coupon bond calculator The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond ) ^ (1 / Period)) - 1 The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1 Here, the ...

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Post a Comment for "44 find the face value of the zero coupon bond"