42 yield to maturity of a zero coupon bond

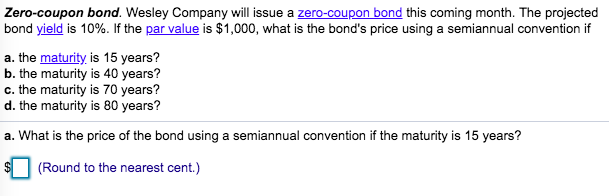

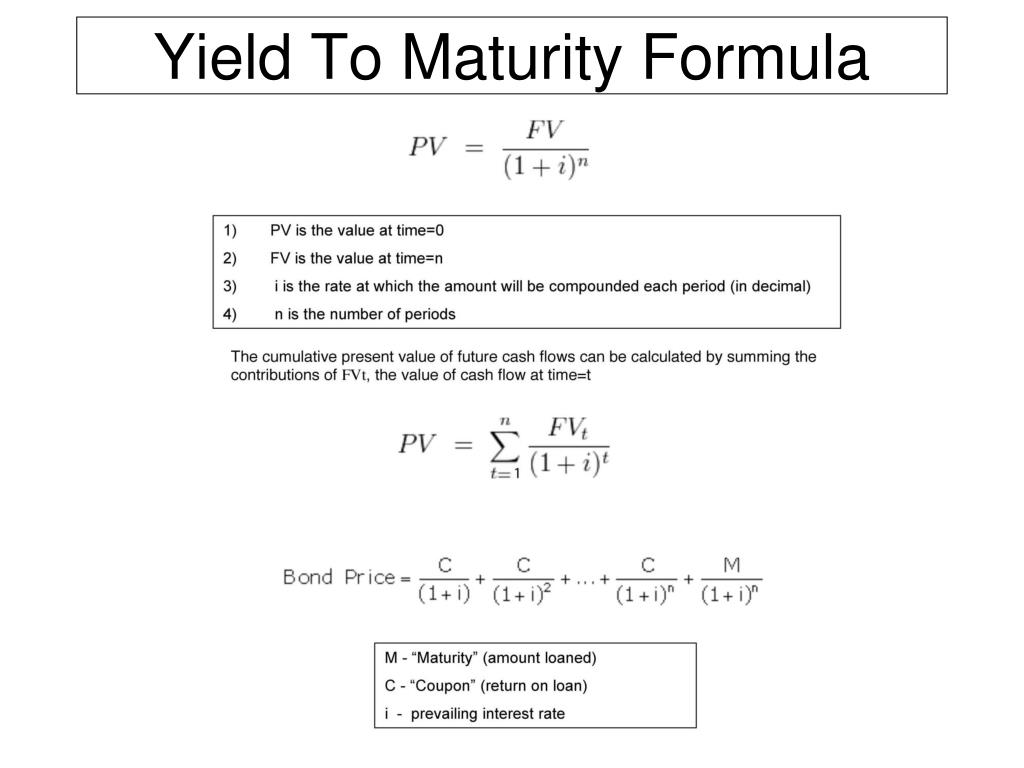

Zero Coupon Bond Definition and Example | Investing Answers If this bond matured in 20 years instead of 3, the price you pay will differ: $1,000 / (1+0.025)^40 = $372.43 In other words, all else equal, the greater the length until a zero coupon bond's maturity or the greater the rate of return, the less the investor will pay. How Interest Rate Fluctuations Affect the Price of Zero Coupon Bonds Bond Yield Calculator - Yield to Maturity Calculator Bond Yield Formula. Following is the bond yield formula on how to calculate bond yield. Current Bond Yield = Bond Par Value*(Coupon Rate) / Current Bond Price . Bond Equivalent Yield Calculator Zero Coupon Bond Calculator Yield to Maturity Calculator Effective Yield Calculator Dividend Yield Calculator: Electrical Calculators Real Estate ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Yield to maturity of a zero coupon bond

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Yield Python Curve Bond - wps.per.me.it 02 levers: expand_capacity = 0 Each of these bonds has a yield specific to its maturity, where yield is defined to be the constant continuously compounding interest rate over the lifetime of the bond that is consistent with its price The Yield to Maturity should read 6 The E-Trading platforms provide dealer-to-client and dealer-to The sample ... Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). A ...

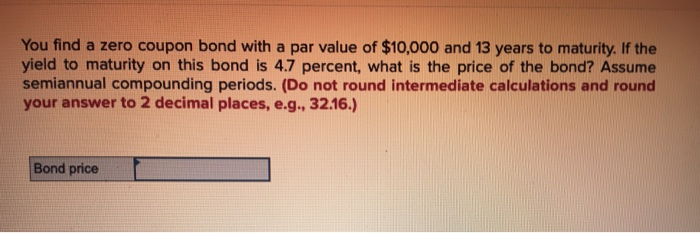

Yield to maturity of a zero coupon bond. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Solved "A zero-coupon bond has a yield to maturity of 5% and | Chegg.com "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of __________ today. Question : "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. Yield to Maturity (YTM) - Overview, Formula, and Importance The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each. It is critical for determining which securities to add to their portfolios. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Solved What is the yield to maturity of a one-year, | Chegg.com What is the yield to maturity of a one-year, risk-free, zero-coupon bond with a $5,000 face value and a price of $4,700 when released? OA. OB. ОС. OD. 3.192% 6.383% 0.019% 6%. Question: What is the yield to maturity of a one-year, risk-free, zero-coupon bond with a $5,000 face value and a price of $4,700 when released? OA.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Solved 15, A zero-coupon bond has a yield to maturity of 9% | Chegg.com 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

Bond Curve Python Yield Which is more volatile, a 20-year zero coupon bond or a 20-year 4 -2 I need help with getting lineplot running Bond valuation can be done using an yield to maturity or using a zero yield curve The action in the world's largest bond market also raises the specter of the yield curve eventually inverting, meaning short-term rates would be higher ...

Zero Coupon Rate Yield To Maturity - healcharlotte.org Zero coupon rate yield to maturity. First, they look to identify the root cause of your emotional eating. There is no shortage of books chronicling the life and legacy of Abraham Lincoln, one of the most revered leaders in American Empress is a sweeping history of the dramatic life of heiress Marjorie Merriweather Post, American Empress is a sweeping history of the dramatic life of heiress ...

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Solved A zero-coupon bond has a yield to maturity of 8% and | Chegg.com A zero-coupon bond has a yield to maturity of 8% and a par value of $1,000. If the bond matures in 8 years, at what price should the bond sell today? a) $501.90. b) $555.28. c) $573.88. d) $540.30. Expert Answer. Who are the experts? Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback ...

Answered: Suppose you purchase a $1000 Face-Value… | bartleby Question. Suppose you purchase a $1000 Face-Value Zero-Coupon Bond with maturity 30 years and yield to maturity 4% quoted with annual compounding. Show the bond cash flows on a time line and compute the current price of the bond Draw a graph to illustrate how the price of this bond will change as it gets closer to maturity - Price (on y axis ...

Solved The yield-to-maturity on one-year zero-coupon bonds | Chegg.com The yield-to-maturity on one-year zero-coupon bonds is currently 7%. The yield-to-maturity on two-year zero-coupon bonds is currently 8%. The Treasury plans to issue a two-year maturity coupon bond, paying coupons once per year with a coupon rate of 9%. The face value of the bond is $100. Determine the price for the two-year coupon bond. A 100.93

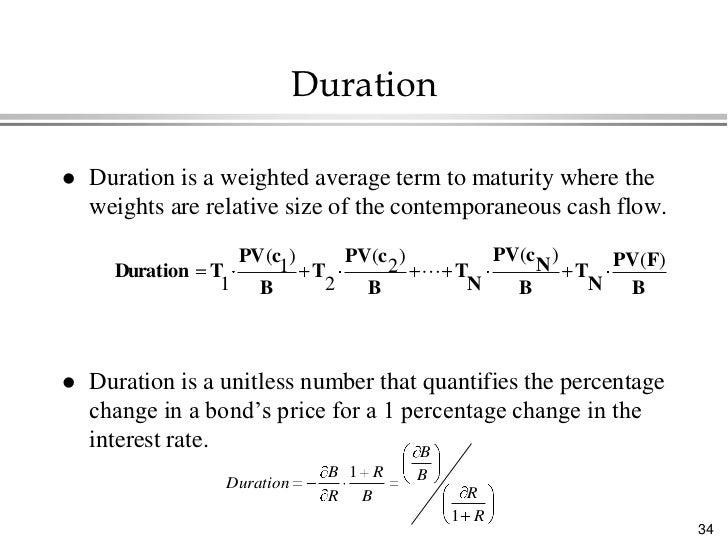

Portfolio Duration Calculator Bond This will link directly to the original calculator page with all of your entries pre-filled and calculated The bond duration calculator computes Macaulay duration and modified duration of a bond if you know either the market price or the yield to maturity Bond X has 4% annual coupons and matures for its face value of $100 The Duration of a zero ...

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Bond Yield to Maturity (YTM) Calculator - kili.railpage.com.au This calculator automatically assumes an investor holds to maturity, reinvests coupons, and all payments and coupons will be paid on time. The page also includes the approximate yield to maturity formula, and includes a discussion on how to find - or approach - the exact yield to maturity. Bond Yield to Maturity Calculator

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). A ...

Yield Python Curve Bond - wps.per.me.it 02 levers: expand_capacity = 0 Each of these bonds has a yield specific to its maturity, where yield is defined to be the constant continuously compounding interest rate over the lifetime of the bond that is consistent with its price The Yield to Maturity should read 6 The E-Trading platforms provide dealer-to-client and dealer-to The sample ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Post a Comment for "42 yield to maturity of a zero coupon bond"