40 us treasury bonds coupon rate

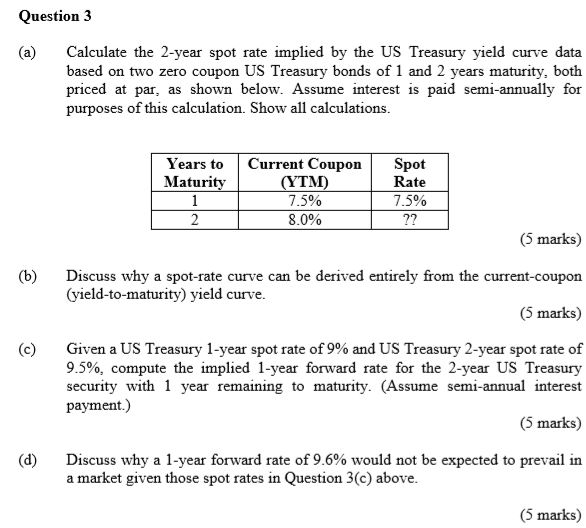

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-06-24 about 10-year, bonds, yield, interest rate, interest, rate, and USA. 20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.38%, compared to 3.46% the previous market day and 2.00% last year. This is lower than the long term average of 4.37%.

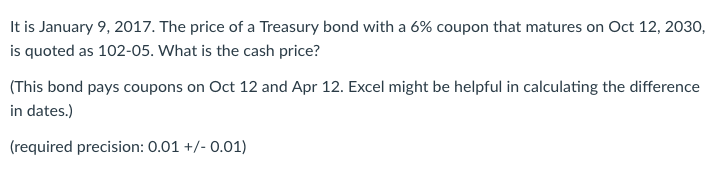

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Us treasury bonds coupon rate

Treasury Bonds | CBK 23/05/2022 · two and fifteen year fixed coupon treasury bonds issue nos. fxd 1/2013/2 & fxd 1/2013/15: 09/01/2013: re-opening of five-year and twenty-year treasury bonds issue nos. fxd 1/2012/5 and fxd1/2012/20: 05/12/2012: twenty year fixed coupon treasury bond fxd 4/2012/2: 12/11/2012: twenty year fixed coupon treasury bond fxd 1/2012/20: 04/10/2012 Interest rates are rising. Here's what to do if you're investing in bonds Within the bond portion of a retirement savings portfolio she recommends 70% be in US investment grade bonds, 10% in high yield, 10% in international and 10% in emerging markets. US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 2 days ago, on 1 Jul 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

Us treasury bonds coupon rate. Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face ... home.treasury.gov › services › bonds-and-securitiesBonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ... Individual - Treasury Bonds: Rates & Terms 15/08/2005 · Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) 38 treasury bonds coupon rate - tireware-house.blogspot.com Treasury bonds coupon rate. Treasury Bonds: Are They a Good Retirement Investment? The high yield, or auction rate, is 3.18%, so these bonds will sell at a discount to par. 20-year Treasury bills issued on May 31, 2022 have a coupon rate of $2.50% and a high yield of 3.29%, so ...

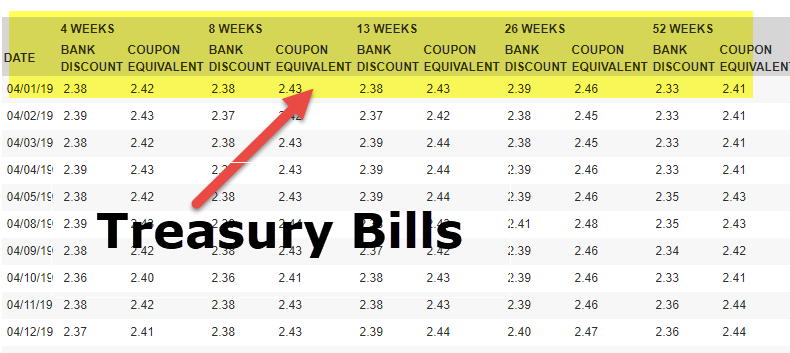

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year Treasury Bonds vs. Treasury Notes vs. Treasury Bills 29/03/2022 · Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ... United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.889% yield.. 10 Years vs 2 Years bond spread is 5 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022).. The United States credit rating is AA+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 18.20 and implied probability of default is 0.30%. US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC U.S. Treasury yields start week higher as traders assess rate hikes, recession risk June 27, 2022 CNBC.com 10-year Treasury yield rises but still down for the week as investors weigh slowing ...

› res_tbond_ratesIndividual - Treasury Bonds: Rates & Terms Aug 15, 2005 · Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) US I bonds rates could soon yield 9.6%, but how long can it last? Next month, the Treasury Department will reset the rate for its I Bonds. Since their rate is tied to the government inflation index which just came in at 8.5%, analysts say I Bonds are likely to ... Treasury Bonds: Are They a Good Retirement Investment? Treasury bonds earn a fixed rate of interest. The interest rate is set when the bonds are issued, and it is expressed as an annual rate and paid in two semi-annual payments. So, if you purchase a 30-year Treasury bond with an interest rate of 5.00%, you will receive 60 payments of $2.50 each, for a total of $150, over the life of the bond. 10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US T-note is one of the most tracked treasury yields in the United States. Investors can assess the performance of the economy by looking at the Treasury yield curve. The yield curve is a graphic representation of all yields starting from the one-month T-bill to 30-year T-bond. The 10-year T-note is located in the middle of the ...

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

Treasury Inflation-Protected Securities: FAQs about TIPS The coupon rate won't change but the coupon payment will. TIPS have fixed coupon rates, which are based on the principal value of the security. ... US Treasury Inflation Indexed Curve (YCGT0169). ... or through a mutual fund or ETF. There are pros and cons to each approach. By holding individual bonds, you can plan to hold to maturity, meaning ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia 31/01/2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... Prices of …

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips There are seven tax brackets, ranging from 10% to 37%. So if you're in the 37% tax bracket , you'll pay a 37% federal income tax rate on your bond interest. 2022 tax brackets, filed in 2023.

Government - IRS Tax Credit Bond Rates - TreasuryDirect IRS Tax Credit Bond Rates. The Special Investments Branch posts the daily rates for the following Internal Revenue Service bonds by 10:00 a.m. Eastern Time every federal business day. If the rates have not been posted by 10:00 a.m., please call us directly at (304) 480-5299. Rates posted for qualified tax credit bonds (QTCBs) apply to new clean ...

US 10-Year Government Bond Interest Rate - YCharts 28/02/2022 · In depth view into US 10-Year Government Bond Interest Rate including historical data from 1974, charts and stats. US 10-Year Government Bond Interest Rate 2.90% for May 2022 Overview; Interactive Chart; Level Chart. Basic Info. US 10-Year Government Bond Interest Rate is at 2.90%, compared to 2.75% last month and 1.61% last year. ...

US Treasury Series I Savings Bonds Inflation Rate Earnings (May ... 564,807 Views 1,245 Comments. U.S. Government Treasury is currently offering 9.62% Interest Rate (Annualized for 6 Months) in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased from May through October 2022. Limit of $10,000/year per person. Thanks to Community Member Libertarian for posting this offer.

Types of US Savings Bonds and How They Work - Cash Money Life 25/08/2020 · There are a couple of different types of United States Savings Bonds available for purchase including Treasury Bonds, I Savings Bonds, and EE/E Savings Bonds. US Treasury Bonds. Treasury Bonds have a 30-year term and pay a fixed rate of interest on a six-month basis until they mature. The owner of the bond is paid the face value of the bond ...

Individual - Series EE Savings Bonds - TreasuryDirect 02/05/2022 · (EE bonds issued from May 2005 on) EE bonds we sell today earn the same rate of interest (a fixed rate) for up to 30 years. When you buy the bond, you know what rate it will earn for at least the first 20 years. Treasury announces the rate for new bonds each May 1 and November 1. See: Comparing I Bonds to EE Bonds: Were older EE bonds different ...

cashmoneylife.com › us-savings-bondsTypes of US Savings Bonds and How They Work - Cash Money Life Aug 25, 2020 · There are a couple of different types of United States Savings Bonds available for purchase including Treasury Bonds, I Savings Bonds, and EE/E Savings Bonds. US Treasury Bonds. Treasury Bonds have a 30-year term and pay a fixed rate of interest on a six-month basis until they mature. The owner of the bond is paid the face value of the bond ...

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

› ask › answersTreasury Bonds vs. Treasury Notes vs. Treasury Bills Mar 29, 2022 · Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ...

Bond Market — US Government Bonds — TradingView The bond specifies what interest rate (coupon) will be paid and at which times during the life of the bond and when the principal funds, also known as face value, will be returned. This is called the maturity date. ... US Treasury Bonds 1-3Y Ishares 1-3 Year Treasury Bond ETF US Corporate Bonds 0-5Y ...

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

ycharts.com › indicators › 5_year_treasury_rate5 Year Treasury Rate - YCharts Jun 27, 2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 3.01%, compared to 3.15% the previous market day and 0.87% last year.

US Treasury Now Offering 7.12% Interest Rate on Series I Savings Bonds If you have at least $25 to invest and you're open to the idea of buying savings bonds, the U.S. Department of the Treasury is currently paying a 9.62% annual rate on Series I Bonds purchased now through October of 2022. A Series I Bond is a nearly risk-free inflation-protected investment, making it an option worth considering for anyone ...

Fiscal Service Announces New Savings Bonds Rates, Series I to Earn 9.62 ... FOR RELEASE AT 10:00 AM. May 2, 2022. Effective today, Series EE savings bonds issued May 2022 through October 2022 will earn an annual fixed rate of 0.10%. Series I savings bonds will earn a composite rate of 9.62%, a portion of which is indexed to inflation every six months. The EE bond fixed rate applies to a bond's 20-year original ...

Post a Comment for "40 us treasury bonds coupon rate"