42 zero coupon bond investopedia

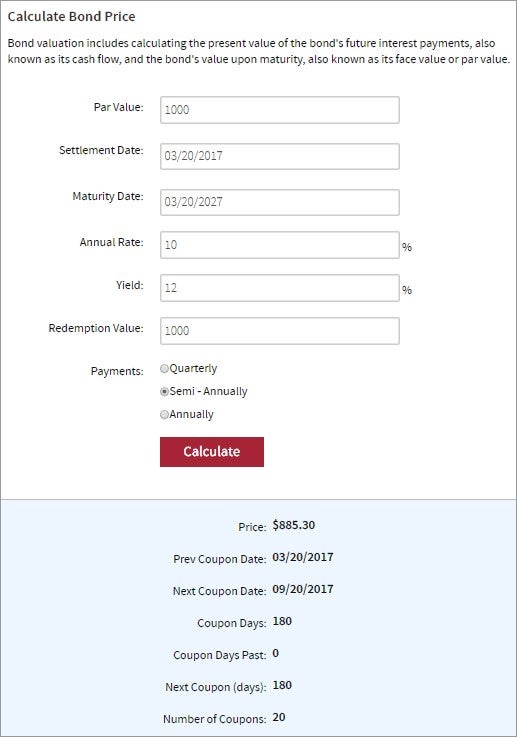

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Pricing using the Zero-Coupon Yield Curve and an Arbitrage-Free ... This holds because the binomial interest rate tree is arbitrage-free. However, the spot curve will not work for bonds with embedded options. Example: Zero-Coupon Yield Curve. A three-year bond with no embedded options pays 5% annual coupons. Given the following spot curve, the bond price with a face value of $100 is closest to:

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.456% yield.. 10 Years vs 2 Years bond spread is 97.7 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.40% (last modification in May 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

Zero coupon bond investopedia

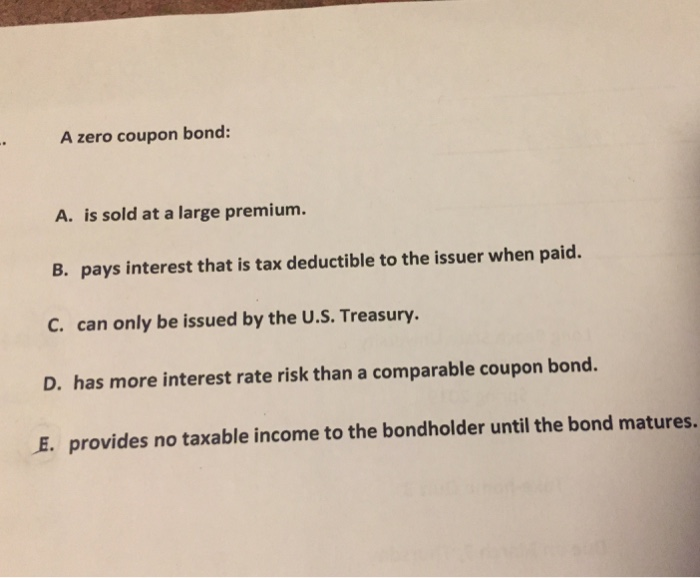

Bond Definition: What Are Bonds? - Forbes Advisor Using the $1,000 example, if a bond has a 3% coupon, the bond issuer promises to pay investors $30 per year until the bond's maturity date (3% of $1,000 par value = $30 per annum). Yield: The ... Zero Coupon Bond Value - My Blog For a zero-coupon bond, maturity and duration are equal since there are no regular coupon payments and all cash flows occur at maturity. Because of this feature, zero-coupon bonds tend to provide the most price movement for a given change in interest rates, which can make zero-coupon bonds attractive to investors expecting a decline in rates ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up ...

Zero coupon bond investopedia. Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What Are Series EE Bonds? - Forbes Advisor Commissions do not affect our editors' opinions or evaluations. Series EE bonds are a type of low-risk U.S. savings bond that are guaranteed to double in value after 20 years. Because they are ... Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula: An Introduction To Bond Markets › bonds-4689778Introduction to Investing in Bonds - Investopediawww.investor.gov › introduction-investing › investing-basicsSavings Bond ... Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" ...

Impact of Bond Yields on Stock Market - The Enigmatic Pen The zero-coupon bonds are issued at a value lower than the face value and on maturity, the holder gets the face value. Just like the dividend yield is calculated as the dividend amount divided by the traded price of the stock, the bond yield is computed as the coupon payment divided by the traded price of the bond. Suppose you buy a 10-year ... What Is a Zero Coupon Yield Curve? (with picture) The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ... All the 21 Types of Bonds | General Features and Valuation | eFM A plain vanilla bond is a bond without unusual features; it is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there ... Negative-Yielding Bonds - How it works and why it's increasing Each year the investor receives $5 in coupon payments and when the bond matures, they receive $100 in par payment. Even though the investor paid more than the par value, the yearly coupon payments made up for the difference. ... As countries put in negative interest rates, it leads to the creation of government bonds that have sub-zero yields.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly if the Fed raises interest rates. They also ... Zero-Coupon Swap Definition - mtanetworks.com A zero-coupon swap is an exchange of income streams but the stream of fixed-rate payments is made as one lump-sum payment. ... Investopedia 100 Wealth Management Portfolio Construction Financial Planning Academy Popular Courses Investing for Beginners Become a Day Trader Zero Coupon Bond Yield: Formula, Considerations, and ... - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Bootstrapping Spot Rates - CFA, FRM, and Actuarial Exams Study Notes Bootstrapping spot rates is a forward substitution method that allows investors to determine zero-coupon rates using the par yield curve. The par curve shows the yields to maturity on government bonds with coupon payments, priced at par, over a range of maturities.. Bootstrapping involves obtaining spot rates (zero-coupon rates) for one year, then using the one-year spot rate to determine the ...

Buying I-Bonds Can Help You Beat Inflation - AARP I Bonds are inflation-protected savings bonds, issued and guaranteed by the United States Treasury. Because of the recent high inflation, I Bonds purchased before the end of October 2022 will yield 9.62 percent for the next six months. If inflation stays high, so will the yield. An I Bond has a 30-year maturity, which means it will pay ...

Zero-Coupon Mortgage Definition - Investopedia Zero-Coupon Mortgage: A form of commercial financing in which regular interest and principal payments are deferred until maturity, rather than paid over the course of the loan. While the coupon ...

Zero-Coupon Swap Definition - Investopedia Zero Coupon Swap: A zero coupon swap is an exchange of income streams in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap , but the ...

domestic bonds investopedia kyle zero blog thirty. domestic bonds investopedia. mco security reservation clear hayabusa leather jacket gsx 1300 adidas military boots brown places to visit in goa with family HOME; NEWS; domestic bonds investopedia; domestic bonds investopedia. 2022年5月12日

Inflation Swap - Overview, How It Works, and Example Two parties enter into a zero-coupon inflation swap. They agree on a 2% fixed rate and a floating rate linked to the CPI. The contract's notional amount is $10M and a maturity date of five years from today. At inception, the CPI level is at 128. At maturity, the parties swap the lump sum cash flow. Suppose that the CPI rose to 139.

Zero-Coupon Convertible - Investopedia Zero-Coupon Convertible: A fixed income instrument that is a combination of a zero-coupon bond and a convertible bond. Due to the zero-coupon feature, the bond pays no interest and is issued at a ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up ...

Zero Coupon Bond Value - My Blog For a zero-coupon bond, maturity and duration are equal since there are no regular coupon payments and all cash flows occur at maturity. Because of this feature, zero-coupon bonds tend to provide the most price movement for a given change in interest rates, which can make zero-coupon bonds attractive to investors expecting a decline in rates ...

Bond Definition: What Are Bonds? - Forbes Advisor Using the $1,000 example, if a bond has a 3% coupon, the bond issuer promises to pay investors $30 per year until the bond's maturity date (3% of $1,000 par value = $30 per annum). Yield: The ...

/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "42 zero coupon bond investopedia"