41 a general co bond has an 8% coupon

General Dynamics, Biden's $770B Defense Bill, And ... - SeekingAlpha So an investment here is similar to owning a bond with an 8% yield and, at the same time, with a coupon payment increase of ~8% per year, leading to very favorable odds of double-digit return in... Coupon Rate: Definition, Formula & Calculation - Study.com The $100 is the annual interest. If you divide the annual interest by $1,000, which was the initial loan amount, your annual yield is ten percent. This is the same as the interest rate you...

Municipal vs. Corporate Bonds: How to Choose As noted above, if it's a tax-deferred account, such as an IRA or 401(k), then corporate bonds will likely make more sense than munis. A key benefit of municipal bonds is that their coupon payments are generally exempt from federal and potentially state income taxes, and they aren't subject to the 3.8% tax on high earners' investment income.

A general co bond has an 8% coupon

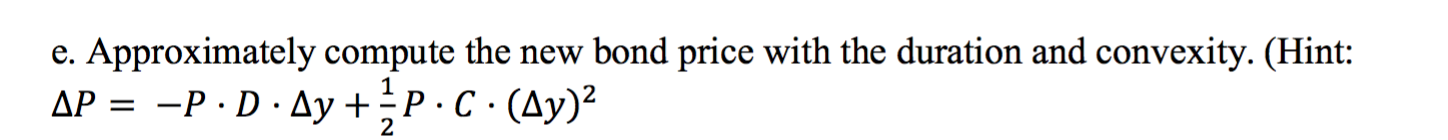

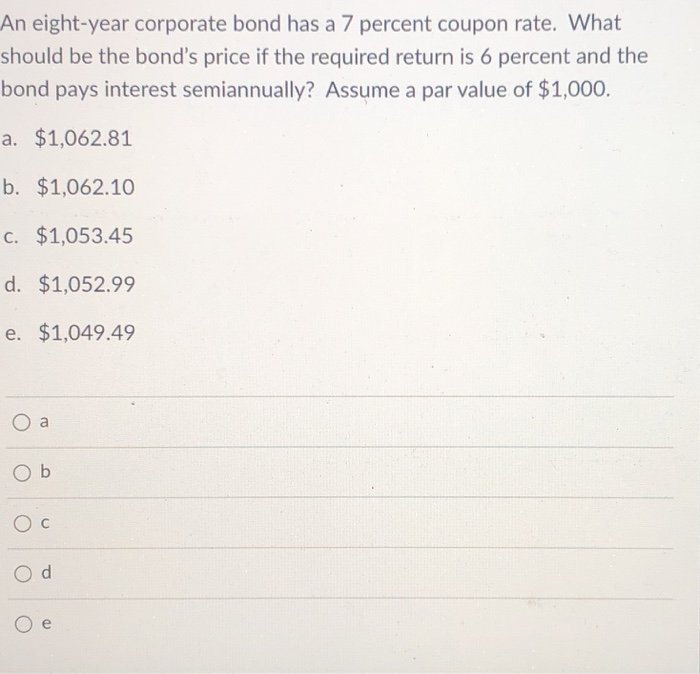

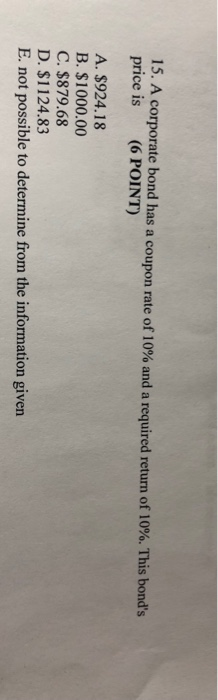

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). How to calculate the present value of a bond - AccountingTools Go to a present value of an ordinary annuity table and locate the present value of the stream of interest payments, using the 8% market rate. This amount is 3.9927. Therefore, the present value of the stream of $6,000 interest payments is $23,956, which is calculated as $6,000 multiplied by the 3.9927 present value factor. quizlet.com › gb › 443875272Fixed Income CFA Level I Flashcards - Quizlet B is correct. A credit-linked coupon bond has a coupon that changes when the bond's credit rating changes. Because credit ratings tend to decline the most during recessions, credit-linked coupon bonds may thus provide some general protection against a poor economy by offering increased coupon payments when credit ratings decline.

A general co bond has an 8% coupon. › terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Say that a $1,000 face value bond has a coupon interest rate of 5%. No matter what happens to the bond's price, the bondholder receives $50 that year from the issuer. However, if the bond price... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. study.com › learn › bonds-in-finance-questions-andBonds in Finance Questions and Answers | Study.com Jackson Central has a 6-year, 8% annual coupon bond with a $1,000 par value. Earls Enterprise has a 12-year, 8% annual coupon bond with a $1,000 par value. Both bonds currently have a yield to matu...

QUESTION 2 A. Today is 31 December 2021. Adam & | Chegg.com RM1,000 par value convertible bonds from Platinum Bhd 4 years ago. The bond which will mature on 31 December 2026 pays 8% coupon semi-annually. However, it is stipulated in the agreement clause that the bond is callable at any time before the period of maturity ends. The prevailing market interest rate of similar bond is 2% above the coupon rate. Yield to Maturity and Default Risk - Do Financial Blog Consider an 8% coupon bond selling for $953.10 with three years until maturity making annual coupon payments. The interest rates in the next three years will be, with certainty, r1 = 8%, r2 = 10%, and r3 = 12%. Calculate the yield to maturity and realized compound yield of the bond. 6. GENERAL MOTORS CO.DL-NOTES 2017(17/27) Bond - Insider The General Motors Co.-Bond has a maturity date of 10/1/2027 and offers a coupon of 4.2000%. The payment of the coupon will take place 2.0 times per biannual on the 01.04.. At the current price of ... Muni Bond Boom Is Sputtering as Interest Rates Rise - WSJ Benchmark yields on triple-A, 10-year, tax-exempt general-obligation muni bonds were 2.34% on Friday, compared with 1.03% a year earlier, according to Refinitiv Municipal Market Data.

› Scripts › FAQViewReserve Bank of India - Frequently Asked Questions The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below: Annual coupon interest = 8.24% x ₹100 = ₹8.24. Current yield = (8.24/103) X 100 = 8.00%. The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return. › publications › p550Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Solved CASE STUDY Huonville Fisheries Company Ltd (HFC) is a - Chegg Company's bond is traded at a price of $980. The bond has 10-year term, 8% coupon rate paid semi-annually and face value of $1,000. In addition, company's equity has a beta of 1.2 while the risk-free rate in the market is 3% and market portfolio return is estimated to be 12%. BONDS | BOND MARKET | PRICES | RATES | Markets Insider The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and therefore owes a debt to the purchaser of the bond.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

What do rising interest rates mean for bonds? | Stockspot Over the first quarter of 2022, Australian government bonds had one of their worst quarters on record. For example, the yield on five-year government bonds rose from 1.3% to 2.6%. Since the coupon is fixed, the 1.3% increase in yield came about by the price of the bond falling by roughly 5 x 1.3% or 6.5%. The bond ETF that we invest into for ...

Effective Interest Method of Amortization in Excel - ExcelDemy But the real Interest Expense = The book value of the bond x (market rate / 2) = $94757.86 x (8%/2) = $3790.31. Debits increase the expense account. So, I have debited the Interest Expense account (following image) with $3790.31. Your company has paid $3000 cash to the bondholder and credits decrease cash (asset) account. So, credit Cash $3000.

Amortization of discount on bonds payable - AccountingTools ABC International issues $10,000,000 of bonds at an interest rate of 8%, which is somewhat lower than the market rate at the time of issuance. Accordingly, investors pay less than the face value of the bonds, which increases the effective interest rate that they receive.

Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

Piramal Enterprises gets Board nod to raise up to ₹700 cr. through ... The tenure of the instrument is 30 months with a coupon rate of 8% per annum Piramal Enterprises Ltd. on Wednesday said the administrative committee of its board of directors has approved raising...

Temasek offers 1.8% 5-year T2026-S$ Temasek Bond The T2026-S$ Temasek Bond pays a fixed Interest Rate of 1.8% per annum, payable at the end of every six month period, and has a tenor of five years from the expected Issue Date of 24 November 2021. The bonds will be cleared through CDP. The T2026-S$ Temasek Bond will be issued in denominations of S$1,000.

Treasury Inflation-Protected Securities: FAQs about TIPS TIPS have fixed coupon rates, which are based on the principal value of the security. If inflation rises, that rate is based off a higher principal amount. If inflation rises, so do the coupon payments. The table below provides a hypothetical look at a TIPS principal value and coupon payment based on a constant 3% rise in inflation.

Bond Valuation: Formula, Steps & Examples - Study.com And our coupon rate is 10%. That means we multiply $1,000 by 0.10 and this produces our answer. We make an interest payment of $100. Simple, right? Next, we calculate the present values for the...

› 36815004 › General_Mathematics(PDF) General Mathematics Learner's Material Department of ... This learning resource was collaboratively developed and reviewed by educators from public and private schools, colleges, and/or universities. We encourage teachers and other education stakeholders to email their feedback, comments and

Fitch Rates South Carolina's $103MM GO Bonds, Ser 2022 'AAA'; Outlook ... Fitch Ratings - New York - 01 Jun 2022: Fitch Ratings has assigned a rating of 'AAA' to the following series of general obligation (GO) bonds to be issued by the state of South Carolina in June 2022: --$103.415 million GO state institution bonds (issued on behalf of Clemson University), series 2022A. The bonds will be offered for competitive ...

Bond Basics: Issue Size and Date, Maturity Value, Coupon Coupon and Yield to Maturity The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Post a Comment for "41 a general co bond has an 8% coupon"